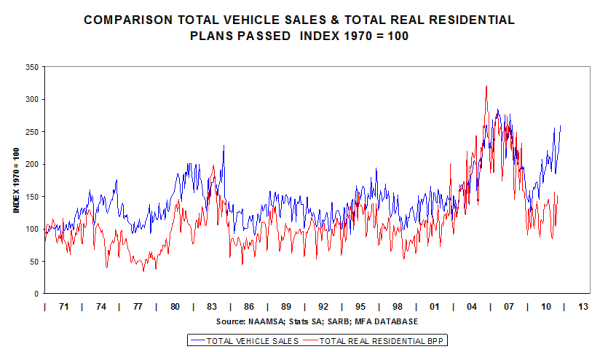

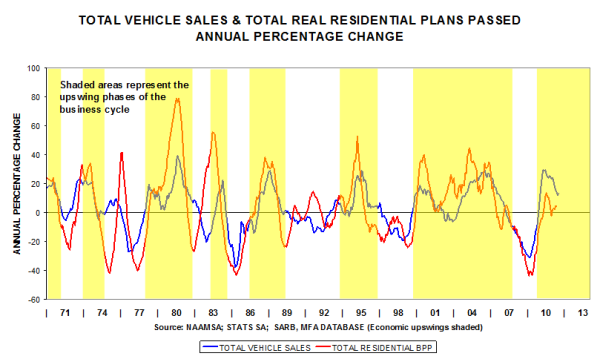

Leading Economic Indicators: Vehicle Sales & Transfer Duty

Total vehicle sales were 30% higher in Sep 2011, compared to Sep 2010. Compared to Aug 2011, they were 5.7% higher, with purchasers by car rental companies responsible for a large part of this fine performance.

The cumulative 12 month moving total in Sep 2011 was 16.2% better.

The annual percentage change of vehicle sales is currently 13.2% p.a.

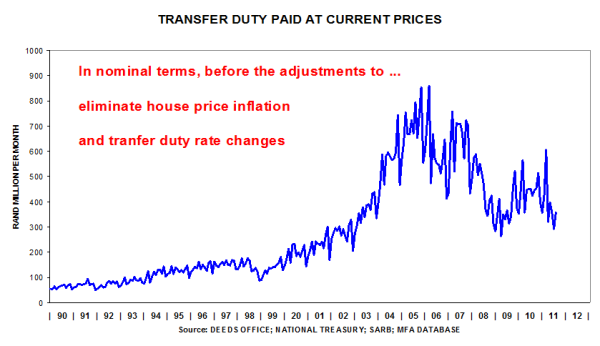

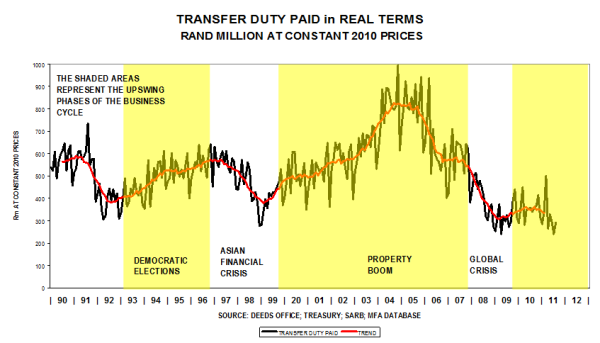

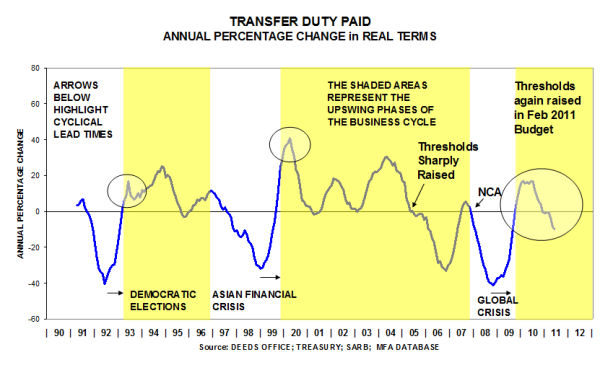

Although Aug 2011 data were somewhat better than July 2011 data, the poor state of the residential property market is currently being reflected in low levels of transfer duty gathered by the fiscus.

In real terms the lacklustre performance is just as evident. The level in Aug 2011 is just a tad better than in July 2011.

When analysing cyclical movements, transfer duty is down by 10% year-on-year. Clear evidence of extreme weakness in the residential property market.

In terms of our common law, any person with full legal capacity may enter into contracts in South Africa unhindered, and this is actually done on a daily basis - be it the foreign tourist who books accommodation or a flight, or purchases a souvenir, a car or a property, or an off-shore company wishing to conduct business in South Africa and entering into a contract for the purchase of South African goods.

If you receive an offer to purchase from a foreigner (i.e. non-resident) you may use your standard sale agreement and generally speaking, the agreement will be as binding as any contract concluded between two South African residents provided the non-resident had full legal capacity to conclude such contract.

Legal Capacity to enter into a sale agreement for land

The only difference in relation to property transfers is the provisions of the Matrimonial Property Act which determines the legal capacity of parties married in or out of community to enter into contracts for the sale of land.

For example, in terms of South African law, a minor, that is a person under the age of 18, would have to be assisted by his or her legal guardian in order to conclude a valid contract, and parties married in community of property will not be able to purchase property without the assistance of the other spouse in terms of the provisions of the Matrimonial Property Act.

Our Matrimonial Property Act does not however apply in respect of foreign marriages and the legal regime that determines the legal capacity of such person to conclude a contract for the sale of land, is determined by the laws of the country where such person was domiciled (living) at the time of the marriage.

The law of such other country will determine if such foreigner has the necessary legal capacity to enter into a contract for the purchase and sale of land in South Africa with or without the assistance of their spouse.

In terms of say Zimbabwean law, parties are generally able to conclude agreements for the purchase of land without the assistance of the other spouse and the same applies in respect of marriages concluded in the United Kingdom.

However, our courts and our Deeds Office cannot take cognisance of or apply foreign law as they would South African law.

The Deeds Office will thus not accept documentation signed by a person who was married in terms of foreign law unless the spouse of that person has consented to such sale and/or is a party to that transaction.

This means that you may have a perfectly valid sale agreement (depending on the marital status of the signatories in terms of their country of origin) but be unable to enforce it.

DEEDS OFFICE REQUIREMENTS IN ORDER TO EFFECT TRANSFER

A valid contract of sale does not in itself confer ownership of land, nor does it provide security for payment of a bond - transfer of ownership pursuant to a valid sale must take place in the Deeds Office.

In terms of our Deeds Office regulations, the Deeds Office requires both spouses to sign all transfer documents in order to pass ownership - regardless of whether or not the sale agreement required the signature of only one or both spouses.

The Deeds Office will not take cognisance of the provisions of foreign law and many sales come unstuck by virtue of this provision where for example, spouses are estranged and cannot be contacted.

The only way around it would be a declaration from the Embassy of such country setting out and confirming that the spouse would not require the assistance of the other spouse.

The transferring attorney's requirements in order to effect transfer would be similar to that of a transfer to a South African resident, except that both spouses would have to sign the conveyancing documentation.

The following documents would be required:

- a certified copy of the Purchasers’ passport;

- a certified copy of their work permit and temporary residency (if applicable);

- a certified copy of proof of residence and South African income tax number (only if applicable).

Estate agents should thus ensure that sale agreements are signed by both spouses in the event of a foreign marriage - this applies regardless of whether or not the person is a resident or non-resident.

Advice:

Make enquiries with your foreign buyer and establish up front if you are going to run into any problems - if so, your foreign buyer can purchase the property through a South African registered company in which event spousal consent would not be required.

FINANCING THE TRANSACTION

South African exchange control regulations determine the extent to which non-residents can borrow money locally to fund the purchase.

Non-resident purchaser who does not work in South Africa

A non-resident purchaser will not be allowed to borrow more than 50% of the purchase price to fund the purchase. The balance must be paid in cash and this may be cash generated in South Africa, or off shore funding.

Non-resident purchaser who is on a termporary work permit in South Africa

A person working in South Africa, and who has a temporary work permit, may borrow more than 50% of the purchase price, and the amount of the loan will depend on the bank’s criteria. A condition of the loan will however be that the purchaser reduces the bond to less than 50% of the registered amount before they return abroad.

Some banks may require a work permit of at least 4 years before they would consider a bond for more than 50% of the purchase price.

The banks generally will require the following documentation to consider a non-resident for bond approval:

- a certified copy of the passport;

- 3 months overseas bank statements;

- 3 months payslips (6 months statements and payslips where the Purchaser earns Commission or is paid overtime).

INVESTMENT OF FUNDS IN CONVEYANCERS TRUST ACCOUNT PENDING TRANSFER

Foreign Exchange and Banking regulations have now been amended with regard to the investments of funds for non-residents pending transfer. Conveyancers are no longer able to invest money in a Sec78(2A) account to earn interest for the benefit of the non-resident purchaser and such investments can only be made for people with SA identity documents.

This must be taken into consideration and the standard clause dealing with the investment of the deposit in an interest-bearing account for the benefit of a purchaser must be deleted - the funds will simply be held in trust pending transfer, with no interest accruing to the non-resident purchaser.

INTRODUCTION AND REPATRIATION OF FUNDS

Once a foreigner has introduced cash into the country with a view to purchasing a property, he can repatriate it (together with the profits thereon) provided he has brought the funds through the proper channels when it was first introduced to the country.

The following documentation should be retained by such non-resident purchaser to avoid delays with the repatriation of the funds on resale:

- proper proof must be kept by the foreign purchaser of the origin of the purchasing funds, including statements on the foreign transferring account as well as the receiving conveyancer’s bank statements;

- a copy of the original sale agreement.

Upon the eventual onward sale of the property, application will be made for Exchange Control Approval for the repatriation of the funds, supported by the following documents in addition to the documents as set out above:

- sale agreement (onward sale);

- conveyancers final statement of account reflecting calculation of the sale proceeds;

- foreign bank account information;

- ID and proof of residence of non-resident.

SIGNING OF CONVEYANCING DOCUMENTATION OUTSIDE THE COUNTRY

Conveyancing documents must be signed before either a notary public of the country where the person resides, or at the South African Consulate or Embassy in such country.

This can be a time consuming and expensive exercise which is governed in terms of international law. (The Hague Convention).

It is cheaper to sign such documents with the South African Embassy in say London but an appointments needs to be made to do so and this can take up valuable time.A home is usually the biggest asset a consumer will ever acquire in his or her lifetime, but the stringent implementation of the National Credit Act by financial institutions is making it more difficult for potential home owners to enter the market.

First time buyers and the self-employed are particularly affected. Nearly 50% of employed bond applicants are declined every month, while almost 58% of self-employed applicants cannot secure home loans (source: www.ooba.co.za).

Rent2Buy, a new concept for the South African property market, gives potential buyers and property owners an alternative way to buy and sell properties.

“We negotiate agreements between potential buyers and sellers whereby the buyer concludes a rental agreement with a seller with an option to purchase the property by a certain date and at an agreed price,” explains Meyer de Waal, the founder of Rent2Buy, and a practicing attorney and conveyancing lawyer.

The seller is assured of a selling price for his property in the future, while the buyer pays rent approximately equal to the buyer’s future bond repayment. The buyer is able to take immediate ownership of the property, and takes over the responsibility of the property, including all rates, taxes, levies and maintenance which would apply if he or she were the home owner.

“The idea is that the buyer uses the option period of the contract to prove his affordability and creditworthiness to the bank,” explains De Waal. “This way the buyer can eventually secure a loan to purchase the property. In addition to using the time to save for a deposit, he also shows he can afford the property and be disciplined by paying rent regularly and on time.”

De Waal adds that the three main reasons why bonds are not being granted are:

• The absence of a deposit. Although some banks advertise that 100 percent bonds are being granted again, the success rate of these applications is low.

• Affordability is the second reason. A bank would rather decline a loan than take the risk that the client will not be able to service the loan. This causes a major problem for self-employed applicants in particular.

• The third reason for declining credit has to do with the applicant’s credit history. Many applicants are not aware of the banks' sophisticated credit search engines. A judgment against their name or a late payment of an account stops their application. Banks can easily trace this information.

With this in mind, Rent2Buy launched a home owner education programme designed to train and mentor bond applicants to increase their success rate of securing a home loan in association with Setsmol Training, managed by Solly Molefe. The My Budget Fitness programme looks at improving an applicant’s credit rating and affordability, and essentially puts the applicant on the path to become financially fit for a home loan.

The programme is unique as it assigns personal [or budget] financial trainers to applicants, and uses innovative software to help home loan applicants track their progress and reach a financially fit state. Through mentorship, education and month-by-month guidance, home loan applicants reach affordability and clear their credit record as required under the National Credit Act.

The programme is available to anyone looking to secure a home loan, and not only for customers of Rent2Buy.

“The aim of My Budget Fitness is to help home loan applicants build up and reach a financially fit state, and to remain that way once they’ve secured their bond,” says De Waal.

Solly Molefe adds that potential buyers who start with the My Budget Fitness programme 6 to 24 months before applying for a loan will enhance their ability to secure home loans through the education process. The group aims to ensure that each bond application submitted for a client with a financially fit budget is approved.

For more information visit www.irent2buy.co.za or send an email to This e-mail address is being protected from spambots. You need JavaScript enabled to view it

GEUE v VAN DER LITH (20 NOVEMBER 2003)

APPÈLHOF SAAK: 625/02

1. Die Appèlhof het op 20 November 2003 beslis dat die vereiste gestel in Art. 3(e)(i) van die Wet op die Onderverdeling van Landbougrond (Wet 70 van 1970), naamlik: dat geen deel van landbougrond sonder die Minister van Landbou se toestemming verkoop mag word nie, ʼn absolute vereiste daarstel. Dit beteken dat ʼn kontrak vir die verkoop van ʼn deel van landbougrond nietig is, al word dit opgeskort hangende die Minister se toestemming.

2. In casu het Van Der Lith ʼn deel van sy plaas Cantebury in Limpopo aan die egpaar Geue verkoop. Die kooptransaksie was onderworpe aan ʼn opskortende voorwaarde dat die Minister van Landbou moet toestem tot die beoogde onderverdeling alvorens die koop bindend is. Die Minister se toestemming is inderdaad later verkry toe die egpaar weens ongenoemde rede in die Hooggeregshof in Pretoria vir die nietig verklaring van die kontrak gevra het omdat dit nie aan die vereistes van Art. 3(e)(i) voldoen het nie. Die Hooggeregshof het bevind dat die kontrak nie nietig is nie. Die Appèlhof het beslis dat die kontrak wel nietig is, aangesien dit nie aan die vereistes van Art. 3(e)(i) voldoen het nie. Art 3(e)(i) is ʼn absolute vereiste.

3.1. Die beslissing bevestig dat ʼn kooptransaksie van ʼn deel van landbougrond nietig is, indien die Minister van Landbou se toestemming nie vooraf bekom is nie.

3.2. Die beslissing bevestig verder dat ʼn kontrak vir die verkoop van ʼn deel van landbougrond nietig is, al word dit opgeskort hangende die Minister se toestemming.

4. PRAKTYK NOTA

4.1. Dit is dus raadsaam om die nodige toestemming tot onderverdeling te bekom alvorens u ʼn kontak vir die koop van ʼn deel van landbougrond opstel. U kan professioneel aanspreeklik gehou word vir skade gelei deur die teenkant in ʼn geding indien die verkoper of die koper weens ongenoemde rede vir die nietig verklaring van die kontrak vra omdat dit nie aan die vereistes van Art. 3(e)(i) voldoen het nie.