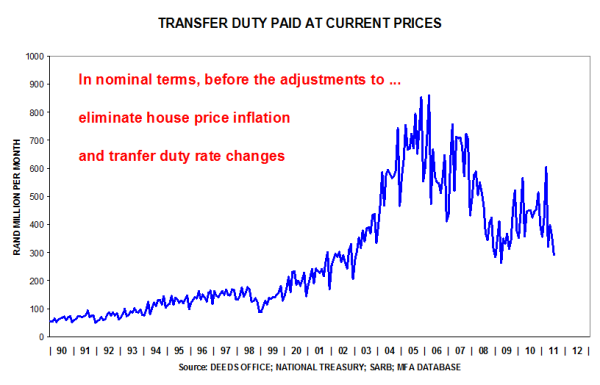

Transfer duty is payable when existing dwellings are purchased (on new houses, VAT is payable).

Therefore, the cyclical movement in this particular tax can be regarded as a good proxy for the well-being of the residential property market.

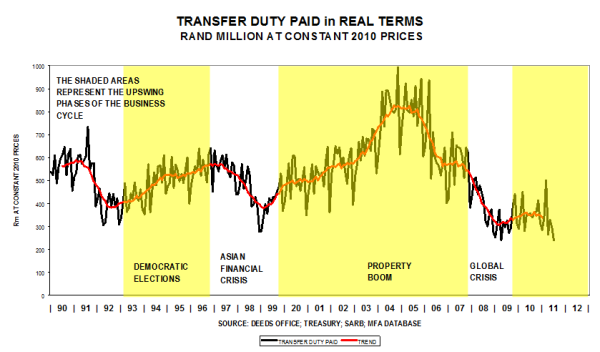

To determine real trends, one needs to adjust the nominal values for house price inflation and for changes to the rate of transfer duty payable.

At the moment the threshold for the payment of transfer duty relates to houses that change hands for more than R600 000.

This threshold is meant to make it more affordable for middle class people to own their own home.

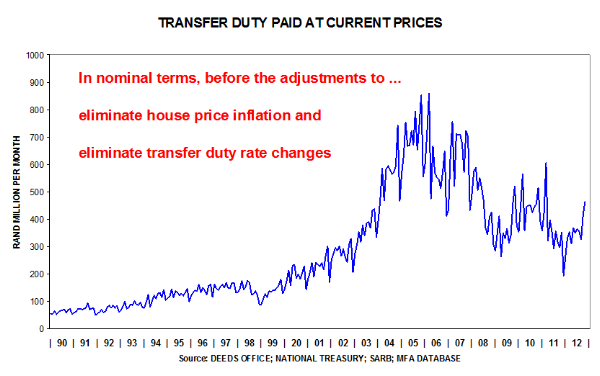

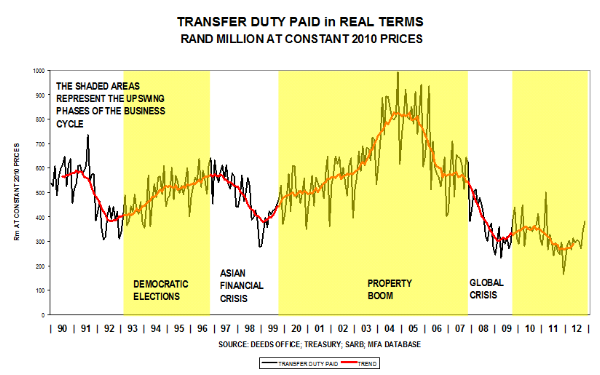

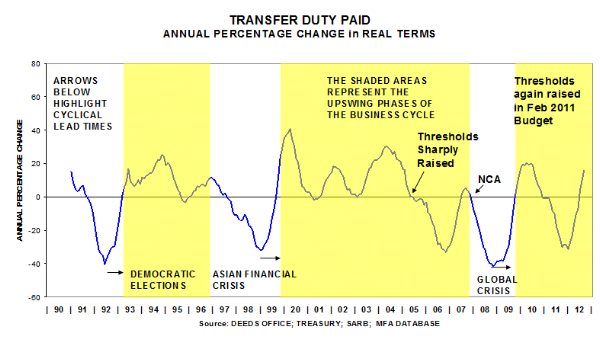

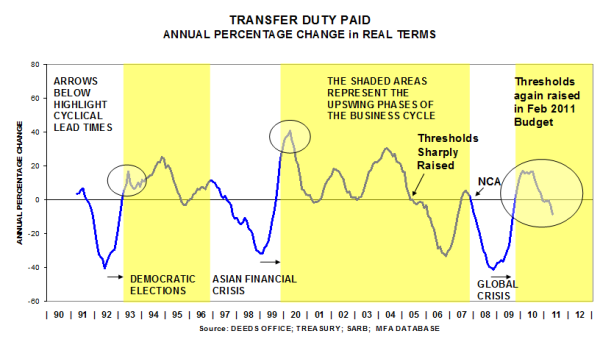

The following 3 graphs, reflecting data up to November 2012, show the following:

- That, in nominal terms, the level of the indicator has recovered from the December 2011 slump.

- That, in real terms (stripping inflation out and adjusting for transfer duty rate changes), a sharp rise in the level of transfer duty is evident.

- That the smoothed annual percentage change has risen to 16%. This finding represents a dramatic improvement because the annual decline in January 2012 was -31.3%.

Due to the drop in mortgage rates during July 2012, it is quite likely that this indicator could improve further in coming months, reflecting better business conditions in the residential property market. We expect this revival to be modest because of the still high debt levels of consumers and low growth in mortgage lending figures.

NCA = National Credit Act Implemented July 2007

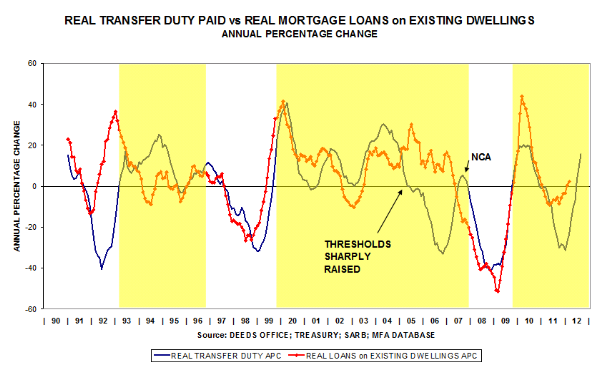

One can assume that most existing dwellings are financed with mortgage bonds.

Because both indicators are related to the residential property market, one could reasonably expect that movements in mortgages advanced for dwellings could be closely linked to movements in transfer duty paid.

It makes sense to compare these two indicators that function as proxies for the well-being of the residential property market.

Observe in the next graph that the cyclical movements, expressed as annual percentage changes, are remarkably close. Where the correspondence is not that close, the divergence can be explained by means of changes to transfer duty rates or increases in threshold levels (e.g. 2005, resulting in a loss to the Fiscus).

One can also observe the dramatic drop in these key indicators during the global financial crisis of 2008/09. During this period the residential property market suffered severely.

Recent trends are positive and it looks like national market conditions are improving. There is clear evidence that the market has finally turned.

Recent amendments to the Income Tax Act have made it possible to transfer residential property from a legal entity (trust, company or close corporation) to an individual, without paying transfer duty, capital gains tax, dividends tax or secondary tax on companies.

Important to note is that the window to make use of this tax amnesty is closing with the deadline of 31 December 2012 fast approaching. This begs the question as to whether there is still enough time left to make use of this amnesty before the end of the year and whether it is not already too late?

According to the SARS Guide to Disposal (“the Guide”), it is a requirement that the interest in the residence must have been disposed of by the entity on or before the 31st of December 2012. The Guide specifically states that it is not a requirement that the property be transferred to the individual in the Deeds Office by the 31st of December 2012.

Accordingly, in order to meet this disposal requirement, the date of distribution or the date of sale (depending on the circumstances), must just be on or before the 31st of December 2012. It is also important that the disposal must no longer be subject to any suspensive conditions on the said date, as the date of disposal will then be regarded as the date on which the suspensive conditions were fulfilled, and if that date is after 31 December 2012, the disposal will not qualify for the tax exemption.

What this means is that if you conclude a sale agreement for the transfer of your residential property from your trust into your name, and such agreement is unconditional before 31 December 2012, you will qualify for the tax exemption relating to such transfer, even though the actual registration at the Deeds Office will only take place in 2013.

To qualify for the exemption the following broad requirements must be met:

- The property must be disposed of to a natural person who is a connected person of the entity as defined in the Income Tax Act.

- A qualifying residence must be one that is mainly used for domestic purposes by one or more natural persons during the period of 11 February 2009 to the date of disposal by the entity.

- The natural persons who used the residence mainly for domestic purposes must be connected persons in relation to the entity at the time of the disposal.

- Within six months of the date of disposal certain specified steps must be taken to terminate the existence of the entity holding the residence.

Persons who are interested in considering utilising this tax amnesty to transfer a residence into their personal names, are urged to not delay and contact an attorney as soon as possible to have the necessary contractual documents put in place and signed before 31 December 2012 in order to qualify for the benefit of the tax amnesty.

Can a foreigner lease or purchase immovable property in South Africa? And, if this is possible, what are the requirements for such a transaction to be valid? Also, can I lease or sell my property to any foreigner? The answers to these questions are pertinent to landlords and sellers garnering interest of foreign tenants and purchasers.

In South Africa the right of a foreigner to purchase immovable property was restricted in the past by the Aliens Control Act. These restrictions were uplifted in 2003 by the new Immigration Act (“the Act”) which repealed the Aliens Control Act and many of its restrictive provisions and now clearly defines who a legal foreigner is and who is not. In short, a legal foreigner is a person in possession of a valid temporary residence permit or a permanent residence permit approved by the Department of Home Affairs.

The new Act makes provision for various temporary residence permits to be issued to foreigners, including amongst others:

- A visitor’s permit

- A work and entrepreneurial permit

- A retired person permit

In principle a landlord or tenant can legitimately lease or sell immovable property to any person recognised under the Act as a legal foreigner.

Importantly, if a foreigner needs to secure funds to buy immovable property in South Africa, he may borrow only up to a maximum of 50% of the purchase price from a South African financial institution. The balance of the purchase price must be made up of foreign funds, which the foreigner will have to transfer to a South African bank account and the non-resident will need to provide proof of earnings as well as comply with the Financial Intelligence Centre Act.

That said, foreigners working in South Africa with a legal work permit, are not regarded as “non-residents” by the South African Reserve Bank. They are considered to be residents for the duration of the period of their work permit and are therefore not restricted to a loan of only 50% of the purchase price.

It is also important to take note that the Act criminalizes the letting or selling of immovable property to an illegal foreigner by making this transaction equivalent to the aiding and abetting of an illegal foreigner and is such an act classified as a criminal offence in terms of the Act.

In conclusion, a legal foreigner may let or buy immovable property in South Africa, provided that he is the holder of either a legal temporary residence permit or a permanent residence permit approved by the Department of Home Affairs. Ensure that you enquire from your potential tenant or purchaser whether they are legally present in South Africa and obtain the necessary proof from them before entering into any transaction with a foreigner. Also take account of the restrictions on local financing, particularly where the procurement of financing is a condition precedent to the agreement.

Amid all the scuttle and commotion in the world of business, there remains a few things that one should appreciate, amongst them… TIME!

This is something that attorneys do not have the luxury of accumulating as one races against the clock with pen, laptop, voluminous documents and a copy of the Supreme Court Act or Rules in tow.

This can be no more evident than in the life of a particularly busy property law practitioner. My facts to my story are simple, and indeed a common occurrence in the sale of immovable property. My client was the purchaser of a house which was sold through a local realty company. At first, the transaction moved smoothly until my client sought to take earlier occupation (as allowed in the contract). Here began a series of complications relating to borer beetle infestation, non-compliance of electrical and plumbing certification, and intermittent damage to the house. It must be said that my client was fortunate not to have moved in before transfer.

Having been astute to the problems arising, my client attempted to resolve the issues through communication with the transferring attorney, realtor and the seller. I pause to add that the seller consisted of 4 individuals who had given authority to one of them to conclude the sale transaction. My client’s attempts of resolution were not successful and the seller’s ‘team’ glossed over the problems raised and was shuffling swiftly to the registration of transfer. At this point, my client decided to seek some legal counsel.

Firstly, we pressed and ensured the compliance of the requisite certification for the borer beetle, plumbing and electrical. Secondly, we delayed the date for the registration of transfer so as to resolve the issues raised. Finally, and after repeated requests, we obtained copies of the relevant authority or Power of Attorney (POA) issued to the seller’s representative. I noticed that the 3 sellers signing the POA did so in South Africa and England respectively.

What is the general law governing these instances?

Section 2 (1) of the Alienation of Land Act 68 of 1981 (the “Act”) states that “no alienation of land shall be of any force or effect unless it is contained in a deed of alienation signed by the parties thereto or by their agents acting on their written authority”. This section expressly states that the parties must have written authority at the time of entering into the sale agreement. It then struck me that the POA signed in England was concluded after the sale agreement was signed. The question begs: does it really matter? I was enjoined to look for further answers.

Professor AJ Kerr, a leading authority on the law of contact and agency, indicates that when a statute specifically sets out that an agent buying or selling land must have written authority, and such agent fails to obtain such authority, the agreement will be void and any subsequent obtaining of the authority will not have the effect of ratifying the agreement.

This intrigued me immensely. I again looked at the Act which does provide, in Section 2 (2) thereof, for a situation where an agreement of sale of land can be concluded by an agent without the necessary written authority. This is however limited to the instance where agents or trustees conclude agreements on behalf of a corporation yet to be formed. This was not relevant to my client’s case.

In looking at case law, a review of the legal position was expressed in the matter of S A I Investments v Van der Schyff N.O. & others 1999 (3) SA 340 (N). The court held that where an agreement to sell immovable property was concluded by an agent without the prior authority, any subsequent authority obtained is not sufficient. The agreement of sale was accordingly void ab initio. This principle was confirmed by a judgment of the Supreme Court of Appeal during 2006 in the matter of B S Thorpe, S Thorpe, A E R Dixon and Another v J A Trittenwein and Another. So, it was not that the act of signing the POA was in question, but the timing of such act.

The case law and commentary on this aspect shows a clear directive: beware concluding a deed of sale for immovable property on behalf of another without obtaining a written pre-authorization to act.

In February of 2011 the City of Cape Town municipality passed a new water by-law which requires that, with effect from 18 February 2011 onwards, all sellers of properties within its jurisdiction must furnish a Plumbing Certificate to the municipality before transfer.

In order to facilitate future compliance with this requirement on the side of the Purchaser, sale agreements usually include a provision that the Seller furnishes a copy of the Plumbing Certificate to the Purchaser, before transfer.

The certificate serves to confirm that –

- the water installation conforms to the national building regulations;

- the property’s water meter is registering;

- there are no defects that can cause water to run to waste; and

- no rainwater leaks into the sewerage system.

The intention of the by-law is to manage our scarce water resources responsibly. The City loses approximately 79 000 million litres of potable water in the distribution system annually and this by-law strives to control water wastage from private homes.

The by-law also provides the City with an opportunity to gradually eliminate the increasing number of storm water connections into sewers, which puts capacity pressure on our sewerage network and treatment capacity. These are typically illegal connections that people make after the approval of the plans and inspection of the completed buildings. There is also a health and safety aspect to prohibiting cross connections between storm water systems and sewers. One of the greatest contributions to health in the last 100 years has been the introduction and management of closed sewer systems to limit and control the spread of disease.

What is the procedure?

- The Seller must acquire the Certificate of Compliance (COC) forms from the City of Cape Town.

- The Seller should select an accredited plumber, i.e. one who has the requisite qualifications in terms of the South African Qualification Authority. If in doubt, contact the City for confirmation. Only accredited plumbers may work on premises or issue a COC.

- The Seller will be liable to pay the COC fee to the plumber.

- The Seller may be assisted by an estate agent for all of the above.

- The conveyancer will request the original COC.

- The conveyancer can now proceed with registration as the Deeds Office does not require a copy of the COC.

What is a plumber expected to check?

- The Hot Water Cylinder installation complies with SANS 10252 and SANS10254.

- The water meter registers when a tap is open and stops completely when no water is drawn. (The alternative would indicate a defect somewhere on the property.)

- None of the terminal water fittings leak and they are correctly fixed in position.

- No storm water is discharged into the sewerage system.

- There is no cross connection between the potable supply and any grey water or groundwater system which may be installed.

- The water pipes in the plumbing installation are properly saddled.

Who bears the cost of repair?

The by-law requires that remedial work and repair be executed prior to registration and in order to obtain the COC. The COC must be issued before transfer and thus the owner (the Seller) must pay for the expenses of repair.

What about older houses with older systems?

Any plumbing installation constructed at any particular time should only conform to what the relevant water services by-law for that particular period required. For example, the City cannot now call for older installations to conform to “10 litre shower heads” or “6 litre basin taps”. Also, galvanized mild steel piping, which was ‘outlawed’ about a decade ago, would have been allowed during the construction of older houses. An exception is automatic flushing cisterns fitted to urinals, for which the period of grace has now expired.

However, be advised that the City of Cape Town will not allow wastage of water, or risk of injury or threat to health. The current by-law gives the Director of Water and Sanitation the authority to serve notice on the owners of homes with older installations constructed under previously promulgated by-laws where such installations have developed defects causing water to run to waste due to defective materials or poor plumbing practices and fittings.

Could the need for a Plumbing Certificate cause a delay in registering the Transfer of a property?

There is no need for the Seller to wait until he has a confirmed buyer before arranging for the inspection or repairs. The Seller will be reminded of this requirement by the estate agent and the inspection can be arranged within a matter of days. Should there be no defects, the certificate would be issued immediately.

The Municipality will not delay the issue of rates and taxes clearances if the water COC has not yet been complied with.

The transfer can be delayed however if the owner does not complete all necessary repairs.

How will the by-law apply to sectional title units?

Most sectional title units have one main meter on common property with sub-meters for each unit. Only the main meter is of importance to the municipal authority. The vast majority of piping is also on common property. In this case, the certification would include the operation of the sub-meter, if applicable, any leaks in the system, and the geyser installation.

Why is it necessary to have the same property re-certified every time the property is sold?

The by-law provides that a certificate is required for every sale being registered as there is no guarantee that a purchaser has not made changes to the water installation before he/she resells the property.

A trust is a legal entity with its own distinct identity. It has the contractual capacity to acquire, hold and dispose of property and other such assets for the benefit of its nominated beneficiaries. All trusts are governed and administered in terms of the Trust Property Control Act, and formed and governed in terms of a trust deed, a written agreement concluded between the trustees and the founder of the trust.

Perhaps the most significant purpose for establishing a trust is the separation of ownership, which is often desired for reasons including asset protection, risk mitigation and limiting ones tax liability. In order for the trust to transact, a trustee(s) are duly appointed in the trust deed who are thereby authorised to act on behalf of the trust. A trustee may act on behalf of a trust provided that he has been duly appointed to act in this capacity in the trust deed, that the trust has been registered with the Master of the High Court and the Master has authorised such appointment in writing by issuing Letters of Authority to this extent. Further, the trustees’ powers to transact are set out in and may be limited by the trust deed.

There are various advantages related to purchasing property in a trust as opposed to buying it in your personal capacity of which the following are the most prominent:

A trust is a flexible vehicle, capable of catering for various changes and uncertainties occurring in one’s life over time e.g. a larger family, death, insolvency, legislative and financial changes and other circumstances.

Since the property is not registered in your name, the value of your personal estate upon death is reduced. The direct implication hereof is a reduction in your estate duty exposure. Also, should the asset value have increased over time, this growth will be excluded from your estate and the capital gains tax (“CGT ”) payable on your estate is reduced accordingly. Executor’s fees pertaining to these assets will also be eliminated.

Provided that you do not establish your trust(s) with the intention of prejudicing creditors, purchasing or transferring a property into a trust helps to protect the specific asset from creditors.

It is advisable to create and operate a trust with appropriate tax advice. In this way a trust will enable you to mitigate your tax liability with specific reference to income tax, CGT, estate duty, donations tax and transfer duty.

Trusts are excellent succession planning tools as a property bought in a trust can remain in the trust indefinitely. Consequently, there is no need to transfer the property from the deceased into the name of his heir. In turn this saves on unnecessary transfer costs and CGT duty.

When finance is required to purchase a property in the current “market” the banks are less likely to grant a 100% bond to a trust and demand a deposit of up to 20% when a trust acquires a property. It appears in some instances individuals may receive up to 100% property finance.

Looking at the downside, the following count under the most burdensome disadvantages of purchasing property in a trust.

All trusts are taxed at an income tax rate of 40%. Consequently, it seems to be more favourable to buy a property in your individual capacity rather than in a trust. Here is why: CGT on the growth of the value of the property comes into play once a property is sold.

Trusts are subject to the highest inclusion rate. 66.66% of the net gain must be included in the trust’s taxable income for the year in which the property is sold. Consequently trusts are taxed at an effective rate of 26.6%. This is compared to individuals who are subject to an inclusion rate of 33.33% and a maximum effective rate of only 13.33%. However, if the profit or gains are distributed to the beneficiaries of the trust during the same tax year, the tax payable may end up being the same amount, as if a natural person is disposing of a second property.

Another downside of the trust owning the property is that the founder does not enjoy control over that property as the trust will be the legal owner of the property and the trustees will have the power to administer same.

Therefore based on the above, if administered correctly, one can benefit tremendously from the exercise of purchasing a property in a trust. It is, however, crucial to determine whether the addition of a trust to your portfolio is necessary and beneficial based on your individual needs and circumstances.

No, never!

Only one of the two taxes will be payable in a transaction. VAT takes preference over transfer duty.

The VAT payable is taken from the seller’s perspective. If the seller is registered for VAT and the property forms part of that seller’s (vendor’s) taxable supply, then VAT is payable and not transfer duty. However, if the seller is not registered for VAT or the property does not form part of that seller’s (vendor’s) taxable supply, then transfer duty will be payable.

Mortgage Bonds: Is the TIFFSKI Judgment a bank's worst nightmare?

A recent judgment handed down by the Supreme Court of Appeal on 30 September 2011 has laid bare the effects of non-compliance with the requirements of Section 34 of the Insolvency Act and should arguably sent shivers down every buyer, banker’s and conveyancing attorney’s spine.

Not only was the sale and transfer of the assets of a business, which was subsequently liquidated, declared void ab initio, but so too the mortgage bonds registered in favour of the bank financing the transaction.

A proper due diligence investigation into all relevant issues is thus of utmost importance when assisting a buyer or a bank evaluating it’s security. It proves that “possession cannot be regarded as “10 points of the law” and possession and even ownership and the security of a mortgage bond can be set aside by a ruling of a court. A bona fide buyer or bank are most likely to be un-aware of a pending liquidation or insolvency of a seller, which liquidation or sequestration can take up to six months to come to conclusion after the sale and full payment of a purchase price has taken place.

The facts of the case can be summarised as follows:

FACTS

- Tiffindell Ski Limited (the company) concluded an agreement of sale with Tiffski Property Investment (Pty) Ltd (Tiffski) on 12 July 2007 in which it sold to Tiffski the immovable property on which it conducted a hotel and resort enterprise along with the said business enterprise (the subject matter).

- The written agreement of sale contained terms quite common in many such agreements and to the effect that possession, occupation and control would be given to Tiffski on the date of transfer, that the agreement would not be published in term of Section 34 of the Insolvency Act, that the company would continue to conduct its business pending transfer and that the agreement represented the entire agreement between the parties.

- Registration of transfer subsequently took place on 16 September 2008 simultaneous with the registration of two mortgage bonds in favour of the State Bank of India Limited (the Bank).

- The company went into liquidation on 23 October 2008 and its liquidators challenged the validity of the transfer of the subject matter and the registration of the mortgage bonds against themselves, arguing that it was void as against them on the grounds that (1) the company went into liquidation within 6[six] months from the transaction (2) the transfer was not in the ordinary course of business (3) the transfer of the business was not for the purpose of securing the payment by the company of its debts and (4) the required notice was not published as set out in Section 34 of the Act.

COURT’S FINDINGS

Upon accepting the liquidator’s arguments, the court rejected Tiffski’s contentions that it was not a “trader” as defined in the Act, that the transaction was in the ordinary course of business, that the transfer fell outside of the 6 month window contemplated in the Act and that due to the transaction being common knowledge it was not necessary to advertise.

It placed specific emphasis on the Bank’s role when considering the validity of the mortgage bonds and rejected the claim by the Bank that it was unaware of the company’s financial difficulties at the time it approved the disputed mortgage bonds. The Bank further contended that the bonds passed by Tiffski over the immovable property transferred from the company constituted real rights in the said property that served as its only “real security” for the monies lent. Thus any order voiding the mortgage bonds would cause it irreparable financial harm.

The Bank sought to rely on a number of court decisions for the proposition that the validity of a mortgage bond duly registered in the Deeds Office is not dependent on the validity of the antecedent contract, a contention that the court also rejected. According to the court in this instance, it is trite that no legal consequence flow from a void jural act. The court stated that “As Tiffski did not acquire ownership of the company’s immovable property – on account of the voidness of the transfer – it must logically flow that Tiffski could not in turn grant any rights, let alone real rights, in the immovable property to the Bank”.

The court then further slammed the Bank saying that it should have insisted on publication of a notice in terms of Section 34 and this being expressly excluded in the agreement of sale must have been done with the Bank’s approval or acquiescence. It was the opinion of the court that to uphold any argument advanced by the Bank in its defense would “defeat the very purpose which the Legislature wished to achieve in enacting Section 34 (1) and benefit the Bank at the expense of the company’s creditors. The Bank must accordingly be taken to have consciously assumed the risk of the transfer of the company’s business to Tiffski falling foul of the legislative requirements and nevertheless agreed to advance moneys to Tiffski fully aware of the risk in doing so.

CONCLUSION

In future, any bank or money lending institution should do well to take head of the court’s hardline approach applied in this case and as the usual remedies relied on in cases of this nature fell on deaf ears in favour of the rights of the company’s numerous creditors. It could in fact signal the start of a growing trend to protect creditors and restrict lending even further, warning any bank to tighten its mechanisms for due diligence, information control and mortgage bond approval criteria even further.

Conveyancing attorneys who attend to the registration of mortgage bonds must also be aware of the risks associated with the registration of a mortgage bond when a court rules the security void, due to non compliance of legal requirements.

With special thanks to Daan Steenkamp.

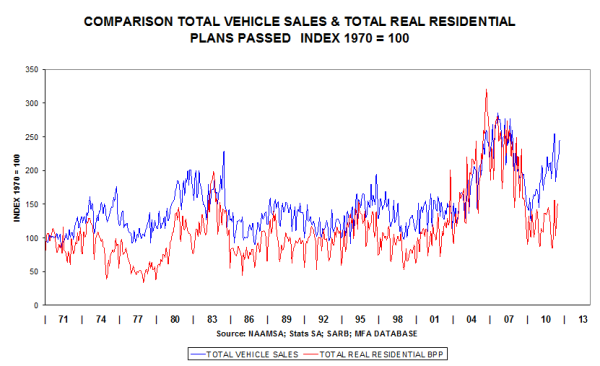

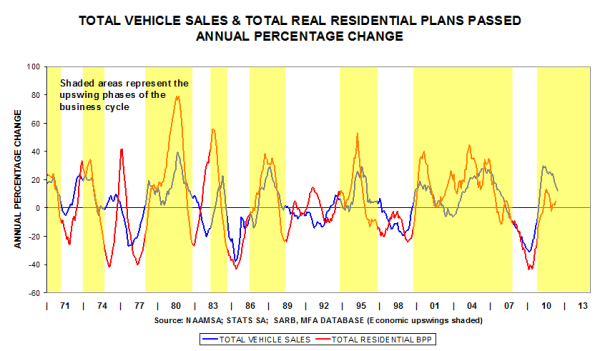

Underneath is our interpretation of buoyant vehicle sales figures and poor transfer duty paid figures.

The latter reflects the poor state of the residential property industry. These divergent trends (i.e. positive in the case of vehicles sold, and negative in the case of the residential property market) suggest that consumers are buying vehicles, but not houses. According to banking economists, the banks enjoy larger profit margins on vehicle finance and credit card debt than on mortgage advances, and the payback period is shorter. Thus, banks have become more selective in their lending behaviour.

Total vehicle sales were 12% higher in Aug 2011, compared to July 2011. Compared to Aug 2010, they were 11% higher.

The annual percentage change of vehicle sales is currently 12%, reflecting the typical cyclical pattern evident in 1973, 1979, 1995 and in 2000 (i.e. a sharp rebound from a low level, then a moderation in the cyclical movement that is due to comparative base effects. This means that current high levels are being compared to growing levels a year ago).

The poor state of the residential property market is reflected in poor levels of transfer duty gathered by the fiscus.

In real terms the lacklustre performance is just as evident. The level in July 2011 is exactly equal to the low point recorded in April 2009 during the global financial crisis.

When analysing year-on-year changes, the cyclical pattern is evident, except that the percentage movement is currently negative, compared with smaller positive movements in 1993 and in 2000 (refer circles). More evidence of extreme weakness in the residential property market.

The Companies and Intellectual Property Commission (CIPC), previously known as CIPRO, have recently confirmed that more than one million companies and close corporations have lately been either deregistered or are in the process of deregistration due to their failure to submit their annual returns.

The legal consequences of deregistration are severe: companies and close corporations lose their status as legal entities, their assets pass to the State and agreements concluded with them may be negatively affected. For example, should such an entity be the owner of immovable property, it would not be possible for it to sell or pass transfer of this property.

The good news is that the new Companies Act (section 82(4) read with Schedule 3, Part 8) provides that application can be made to reinstate the registration of both a company and close corporation if it was deregistered as a result of non-filing of annual returns. Such a reinstatement will have the effect of reviving the company or close corporation’s rights and obligations.

However, when such an entity is the owner of immovable property, additional requirements are laid down: the written consent of both the Departments of Treasury and Public Works are to be obtained prior to lodging the application.

Since the process of transfer of any property owned or purchased by such entities are effectively stayed until such entity is reregistered, significant delays are to be expected when a deregistered entity is involved.

You would therefore be well advised to verify the status of your Company or Close Corporation with CIPC, as well as that of any entity you intend to transact with prior to entering into a contract for the sale of immovable property.